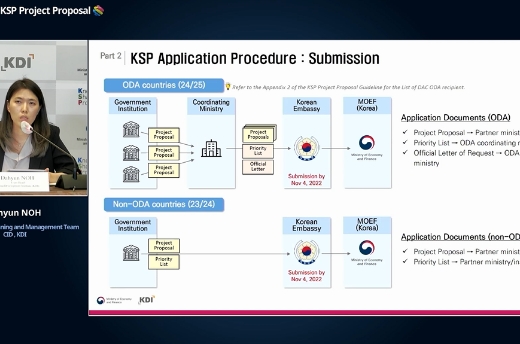

The 2021/22 KSP promoted performance visualization and globalization of K-soft power with an aim to achieve the vision of KSP Advancement Strategy.

The focus was on five out of the 10 key projects that helped revitalize KSP participation, achieve flexible high-quality project planning, and expand the reach of KSP.

- Co-prosperous Knowledge-Sharing Platform for Spreading Korea’s Soft Power

-

Achieving Tangible Outcomes of Korea’s Soft Power

-

Private Project Proposal Program

First adopted in 2022:

56 projects from 49 businesses submitted → 6 projects selected- Private businesses may propose projects in the following cases: 1) when seeking to increase their competitiveness for potential projects (policy and technical recommendations), 2) when a pre-feasibility study is required for a project (preliminary feasibility studies), and 3) when exploring opportunities for global expansion (other types of cooperation).

-

Launch of KSP Plus

4 countries (Uzbekistan, Cambodia, Vietnam, and Jordan) chosen for KSP Plus pilot projects (to be pursued as 2022/23 projects)

- KSP Plus is a comprehensive consultation project model that expands the advisory period (2-3 years), scale (KRW 1 billion or more), and scope (from legislation to infrastructure development) on a country-specific basis.

-

-

Globalization of Korea’s Soft Power

-

KSP Module 2.0

Policy guidance analyzing Korea’s development experience and knowledge on 10 topics in environmental, digital, and public administration fields

- Environment: Supply and conversion of green energy, Industry structure transformation, Act on Carbon Neutrality

- Science & Technology and ICT: Climate response, Digital economy, Advancement of agricultural productivity and industrial structure, Smart city

- Public Administration: Public order, e-Government, Statistics

-

More Consultations with Non-ODA Recipients

- KSP projects conducted with four nations: Bulgaria, UAE, Czech Republic, and Hungary

9 countries including Australia, Saudi Arabia, Poland, and Uruguay chosen for 2022/23 KSP projects

- The goal is to gradually expand cooperation with the non-recipients, move away from merely sharing past development experiences, and conduct joint research leveraging policy development expertise, contributing to building a solid basis for strategic economic cooperation.

- KSP projects conducted with four nations: Bulgaria, UAE, Czech Republic, and Hungary

-

KSP Internship (YKSP) Program

10 interns selected to nurture talent for development cooperation and KSP promotion

- The program invites young talents to participate in KSP projects firsthand, gaining practical experience in development cooperation and enhancing their academic and professional capabilities.

-